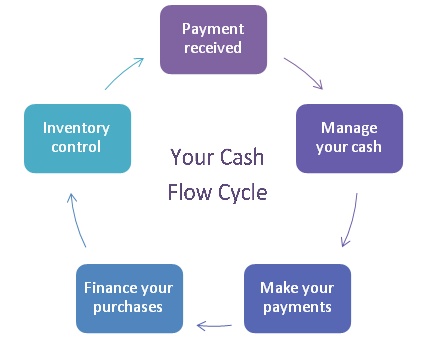

As a growing startup we have personally experienced the challenges of cash flow management so we know how it feels! The truth of the matter is cash flow management is important for all businesses but it is essential for early stage start-ups. Put simply, cash flow management can be narrowed down to delaying outlays of cash as long as possible whilst encouraging and facilitating the payment process for anyone who owes you money in order to receive early payments.

To effectively manage your cash flow you need to set up preventive strategy by making accurate projections. These will include a number of inputs ranging from your customers’ payment histories to your ability to identify upcoming expenditures. Be wary of drawing assumptions based on past performance and ensure that all expenses and seasonal sales fluctuations have been accounted for.

It all comes down to three elements to consider:

- Accounts receivable: what you are owed

- Accounts payable: what you owe

- Shortfalls

Improving Receivables

The best way to think about it is to find the quickest way of converting expenses into revenues. In other words, the fastest way to turn supplies into products, and receivables into cash. Some possible tips for achieving this are:

- Pay close attention when preparing the invoices to make sure all information such as payment date, bank details, etc. is included

- Issue invoices promptly, request proof of receipt and follow up regularly

- Offer promotions to customers who pay their bills in advance

- Introduce credit checks for new non-cash customers

Overseeing Payables

Focus on cash flow management, not profits. At any point when expenses are growing faster than sales, analyze costs and attempt to reduce them.

- When choosing your suppliers don’t rely simply on a low price. Sometimes more flexible payment terms can be more beneficial to cash flow than a low price.

- Use a cash flow worksheet to help you plan or subscribe to companies that send you reminders to alert you when invoices are due.

- Keep your suppliers informed on your financial situation. In this way, you will gain their trust and be able to consult them when you need to delay a payment.

- Make the most out of creditor payment terms (do not make early payments).

Overcoming Shortfalls

For most businesses there will come a point when you lack the liquidity to pay your bills. This situation does not mean your business model has failed but there are some best practices that you need to put in place to avoid this situation repeating in the future.

- PREVENTION: best way of managing shortfalls is to detect the problem as early and accurately as possible and cash reserves are a simple effective way of planning ahead. It is far easier to access capital when you do not need it desperately therefore arranging a financing method before you are short is key.

- TURN TO YOUR SUPPLIERS – a good idea is to turn to your suppliers for help, your financial stability is also in their interest and therefore they can extend your payment terms (this is more likely to happen if you have a good working relation and have always kept them informed about your financial situation).

- PRIORITIZE PAYMENTS – Focus on payroll first (you do not want cash flow issues to damage your team) then turn to key suppliers, and finally ask the rest if you can delay or make partial payments.

- TURN TO INVOICE FINANCING – An effective alternative to gain access to the liquidity blocked in your outstanding invoices is invoice discounting through online platforms. NoviCap allows you to sell your outstanding invoices to professional investors and gain access to capital within 48h paying a transparent and fixed fee. This enables you to take charge of your invoices and thus manage your cash flow effectively.

About the Authors

NoviCap is an online platform which allows Small and  MediumEnterprises (SMEs) to access the capital locked in their long-dated invoices. We provide invoice finance in a fast, flexible, and transparent way while offering professional investors the opportunity to invest in a short-term asset yielding above-average returns. NoviCap is an alumni company of the Barclays Techstars Accelerator and we are based in London and Barcelona.

MediumEnterprises (SMEs) to access the capital locked in their long-dated invoices. We provide invoice finance in a fast, flexible, and transparent way while offering professional investors the opportunity to invest in a short-term asset yielding above-average returns. NoviCap is an alumni company of the Barclays Techstars Accelerator and we are based in London and Barcelona.

We hope you find this brief guide useful and if you have any doubts or questions do not hesitate to contact us on info@novicap.com. To keep up to date with company and sector news follow us on Twitter @novicap and subscribe to ourNewsletter on NoviCap

Leave a Reply