Recently Temenos, one of the sponsors of the Next Bank Europe Conference, released a white paper on industry disruption in the banking sector. Their introduction depicts clearly the urgency to come up with new business models and value propositions.

“Digitization is changing the industry’s dynamics. Cloud computing is lowering the cost of doing business. Improvements in mobile technology are rendering banking anytime, anywhere and are accessible on any device. Big data is making it possible for firms to draw major insights into customers’ lives from their transactions and other data. And social media is providing the opportunity to inject a social context into banking services.”

So these are some examples of what is driving transformation in the industry. But in which direction should the banking industry transform? This was exactly the subject of the Next Bank Conference held in Barcelona on September 18th and 19th: rethinking leadership, customers and new organizations & business. To achieve this, the financial and entrepreneurial ecosystems where united: the established, the new and the ‘yet to come’. Prejudgments fell apart. Thinking about the financial sector and banking, I thought of a room with tied up, cufflinks wearing and dressed up representatives. This was not the case. Sneakers to stay more fixed on the bumpy road of disruptive innovation were prevailing. Finnovista kicked off with the power of collaborative networks: building a community to connect fintech innovation. Through these collisions current practice was rethought and all were eager to find new connections that make us shiver of excitement.

Yet innovation in the Banking Sector could be a very controversial topic. To make everyone comfortable a living room experience was generated on stage for the presentations and interviews. Why controversial? As any industry, also the financial industry is encountering a lot of forces asking for change. However, banks are built on the solid belief of safety, security and no risk taking. Important features for the bank are proximity, relationship and trust. Various tweets during the event reminded us about this juxtaposition of innovate/ change versus no risk/ security.

The Nexus of Forces influencing strategy

Change is being impeded by technological trends that ask for new types of behavior. Related to the Digital Era we live in, important factors are: cloud, information/ big data, social media and mobile. Gartner links features to it as access, delivery and context. Everything is connected and that changes everything. Security, social media and responsiveness ask for a change of mindset.

Banks are used to reason from the internal perspective. With ever more permeable boundaries, they have to start embracing the outside perspective. Dissolving boarders make the ecosystem and network more important. Speaker Carina Szpilka mentions the 2009 concept of BCG: Adaptive Companies. She explains that for most banks this is still thought provoking and that by just taking these cornerstones into account the minds should shift to a more disruptive approach. Central should be the thought: how do we make money and where is the money coming from? She urges the audience to no longer talk about Porters generic strategy of competitive advantage, but to embrace the adaptive advantage: being able to be flexible to the changing pace of technology.

Adaptive advantage consists of:

- Signal: capacity to identify and analyze the data (knowing where to find the right data, hence identifying the right indicators around you)

- Experimentation: being able to experiment and test new ways of doing (loosen the risk averse ties and acknowledge that failure might follow)

- Organization: related to the people and the way they work together. Important is the knowledge sharing flow amongst the different individuals. Work by function should shift to collaborative efforts.

- Eco-system: creating strategic partnerships with players from other industries. Think about a trans-corporate strategy since frontiers are becoming more permeable. Also linked to Open Innovation.

- Eco-Social: earning the license to operate for society. Think about the role of the corporation within the society. Not only the PnL, but also about to what extend involved in society, working on a sustainable future. Hence, having a clear set of values. It is not only about connecting and sharing, but even more about caring and being honest. Increasing transparency makes this a no regret option. We live in The Era of Truth. Later in the afternoon Marco Bressan (BBVA) added: “You can lie with data but you cannot tell the truth without it”.

Changes don’t only ask for a change in strategy. The strategy will only succeed if it will be followed by a change in leadership skills. It implies that the style should transform to become much more facilitative, able to navigate, able to self-correct and react when needed to shift adaptively and empathize. Only in that way, win-win situations can be created.

From this perspective, a new term is introduced: Wirearchy – the end of hierarchy. Leadership will be driven by passion and manifested in network ties. Note that leadership is also everybody’s job, to make an organization more ready to change, people should feel the autonomy and leadership to take the effort for change and explore new opportunities. The Wirearchy emphasizes the power of being connected, encourage sharing and care about people relentlessly. The Wirearchy is closely linked to nature. Have you ever seen an organism so structurally organized as an organizational chart? No. Hence, it is not natural. Companies should be much more organic. Several speakers stressed that only a network organization can be fast enough to cope with the change.

Disruption is knocking on the door

The big challenges for the financial industry are datafication, increasing customer expectations, unburdening customers, lowering transaction costs and accelerating returns. This asks from industries to change fast. A yearly planning is not sufficient. The new paradigm will move towards data-driven management. If not, the music industry showed that in 15 years’ time the market can decrease with 50%. Will banking encounter the same due to ever lowering transaction costs? Already in 1994 Bill Gates prompted the quote: “Banking is necessary but banks are not.” Most do not believe that the bank will disappear, but the position of the man-the-middle will become precarious. Ben Robinson (Tememos) doubts if there is a long term role in the real-time payment world for tools as MasterCard, Visa and PayPal. Especially with announcement like Apple Pay and the large amount of banks and retailers already backing this service.

At the same time, a large part of world population has no access to banks. A foreseen growth market is making the industry more accessible. This will imply that the price of banking will be brought down through new startups challenging the status-quo. A consequence of commoditizing is that moving into the cloud will become inevitable. Low cost process services will win the battle, according to Ben Robinson.

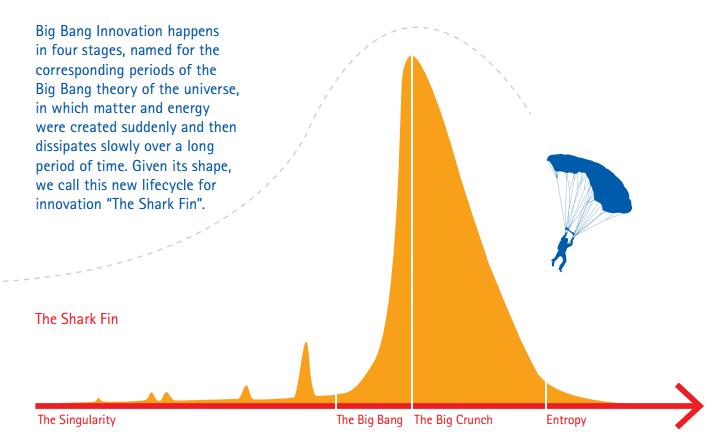

To be prepared for radical changes, companies should implement ‘Shark Fin’ radars. The early warnings of ripples on the surface should be taken seriously. The old adoption curve isn’t applicable to fast changing technologies. If it hits, the impact will be huge. One refers to this as Big Bang Innovation.

Crypto currencies

The big promise of crypto currencies: will they become the successful version of the language Esperanto in the world of monetary exchange? Will Bitcoins surpass the Dollar, ending paper payments? Big advantages are that there is no transaction fee, anonymous, decentralized and easy to transport. Bitcoin is seen as “money without government”.

Startups are trying to profit from this platform by offering new services, like startup IceVault that offers offline storage of private keys and Lamassu offering a Bitcoin ATM in NYC. But also on the interface of social media and crowd funding new initiatives arrive, like ChangeTip: the love button for interest making it possible to reward online content with a small bitcoin donation. Will this be the next LIKE-button? There are fields of unexploited opportunities in the interface of consumer finance and crowd lending.

However, Bitcoin is already referred to as first generation crypto currency. I have talked to a specialist from E&Y, who was highly enthusiastic about the second-generation of crypto currencies. Her big example is San Francisco based startup Ripple ‘The World’s Open Payment System’, which carries community and network in its core practice. Banks in Germany and the Netherlands are already experimenting with it. Why? Because there are quite a lot of inefficiencies when it comes to international transactions. To sum up:

- Multiple points of interaction

- Transaction fees

- Time delay

- Country specific

- Country doesn’t matter anymore, only the currency

Ripple wants to simplify the process by making the payments directly. It has the promise of a short time frame, while having an algorithm to find the best rates.

And what is the difference with Bitcoin? Bitcoin still has an hour clearing time, and there might be a 20% fluctuation in transaction costs. The biggest challenges to be resolved in the third generation? Inscription, identity and security. And perhaps also the currency won’t matter anymore.

Banks as marketplaces

So what thoughts do banks have? I talked to Ramesh from Banca Sella and he told me how they are experimenting with Facebook payments. In their view the community is key. Basically, a bank was created as a trusted institutions to make a transaction between two parties. He believes that this trust will again become the central position in the future. Learning from the past, have the bank as hub for all transactions (not necessarily money). He hopes that boundaries will resolve, especially with regards to restrictions enforced by country regulations. More banks share these thoughts of marketplace and are moving into Facebook, only a few minutes later Knab explained moving into this direction as well.

Talking about providing a market place, the big word is application programming interface – API. Some believe “APIs is where real innovation is going to come from: the “amazonisation of financial services.” An example where the bank is transformed to a platform is the Open Bank Project. API enhances the shift from sales advisor to trust advisor: keep it simple, keep it honest. The new adaptive advantage will be to stay ‘top-of-mind’ in the ecosystem.

The next wave is linked to living enabled by decoupling services. What does this mean? Having a platform with core services to which others can add service components to increase the value proposition. A huge enabler for this type of service will be the developments in the wearables. By means of the platform, the bank will be able to play global and offer banking products in an everyday environment without the customer even noticing the bank, but knowing that it is built on the enabler of trust. Again the trust factor. This asks for a lot of expectation management. It is a shame that the conference didn’t zoom into this topic. It was all about sharing, connecting and trust but how that actually can be achieved and how the expectations in that respect could be fulfilled is apparently for the next edition.

It became clear that none wanted to miss the boat of startups aiming to define the new marketplace with dozens of apps and software programs. Many banks jump on the bandwagon of accelerators. Special startup accelerators and competitions are popping up like mushrooms: Innotribe, Startupboothcamp FinTech (banks like Intesa Sanpaolo and Rabobank recently backed the program) , Erste BeeOne and BBVA Open Talent.

New entrants in the market

New entrants, whether startups or companies entering global playing fields, like upcoming Tigers from Asia as Alibaba that recently went for a IPO on Nasdaq, are of course altering the way of business. Born in Barcelona, Kantox is disrupting the banking industry straight in the heart of London City by providing an alternative to business foreign currency exchange, leapfrogging its neighbors. Also the €50 billion euros invoicing segment is ready for a shakeup. Time to align electronic invoicing with the sharing economy to really creating the paper-free environment. At least, that is the ambition of InvoiceSharing.

Startup Lendstar that competed in the BBVA challenge decided to take the social financial network perspective to make money transactions easy, simple and efficient, putting social interaction central. They jump into the mobile P2P market.

TransferGO is transforming the money transfer system announcing the end for companies like Western Union. Making it able to send smaller amount to anywhere in the world with a transfer in one day.

Winner of the BBVA Open Talent was UK based ClauseMatch. A cloud-based platform for negotiating commercial agreements, enabling cost savings and an increase in liquidity leading to more transparency of the market. Through search they make the best deals available.

All have the following in common: tailored and customized. Based on optimization models they offer personalized service and instant sales opportunities. The main advantage is the reduction of contract and transaction cycles. Digital receivables. All are in search for the next payment system on a digital platform. The first target markets are yet existing digital platforms, which are still time consuming in finance perspective: Apps & music.

Consumer data

Every citizen has a bank to store and handle its accounts. This means that banks have a very huge asset: large customer databases. If the data is analyzed well, they could provide just in time location offers, making consumers life easier. At these kind of markets, start-ups like Venmo aim to enable instant payment to anyone. Banks want to address the ‘Pick and Choose Generation’ by facilitating own experiences instead of pre-packed services. But the call is strong for transparency. Relationships should be reimagined and new ways of interactions will occur. To use the consumer data, concepts like curate, keep and care in a personal manner are more and more important. People trust the human, not the corporate.

However, just more digital is not the answer. Not without a reason the SMS-business in the B2B market is growing because it is much safer and securer for digital banking than a platform like WhatsApp.

Overall, Next Bank Europe proved to be an interesting event with some thought provoking examples. A nice conference organization note: during the whole event drawings where made with the main discussed points. You can see them here.

Small detail: the back of the name badge was featuring all event details: agenda, social media details and QR code to evaluation. Very smart and useful. For next year: include a “reading list” from speakers and release the attendance list. Then knowledge sharing and networking will prosper at its full potential.

Were you inspired to help transform the financial sector? Your next opportunity in Barcelona is the Banco Sabadell’s Hackathon, October 11th-12th.

Cover image courtesy of Shutterstock, Accenture

Leave a Reply